Variable costs are directly related to sales, like cost of goods sold. While many think of labor as a variable cost, because scheduling can fluctuate depending on the day, much of your labor cost is actually a fixed expense, or fixed labor. Labor that is paid on a salaried basis, like the head chef, managers, and bookkeeper, doesn’t typically

Why Would Someone Sell A Profitable Business? Med Lab Biz

Jun 22, 2023To recap, the variable costing income statement is different from the absorption costing income statement in several ways. (1) Only variable production costs are included in cost of goods sold. (2) Manufacturing margin replaces gross profit. (3) Variable selling and administrative expenses are grouped with variable production costs as part of

Source Image: shopify.com

Download Image

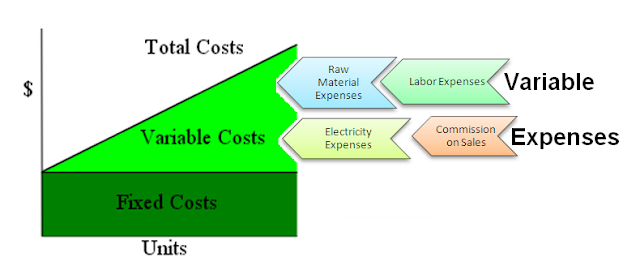

These are calculated by taking the amount of labor hired and multiplying by the wage. For example, two barbers cost: 2 × $80 = $160. Adding together the fixed costs in the third column and the variable costs in the fourth column produces the total costs in the fifth column. So, for example, with two barbers the total cost is: $160 + $160 = $320.

Source Image: deskera.com

Download Image

How to Find Variable Cost: A Guide for Businesses Jan 7, 2024Key Takeaways A variable cost is an expense that changes in proportion to production output or sales. When production or sales increase, variable costs increase; when production or sales

Source Image: restaurant365.com

Download Image

Why Would Labor Be Treated As A Variable Cost

Jan 7, 2024Key Takeaways A variable cost is an expense that changes in proportion to production output or sales. When production or sales increase, variable costs increase; when production or sales Mar 28, 2023Hub. Accounting. March 28, 2023. A variable cost is an ongoing cost that changes in value according to factors like sales revenue and output. Variable costs include labor, raw materials and distribution costs. Businesses with high variable costs such as contract consulting work have lower margins than other companies but also lower break even

Is Labor a Fixed Cost or Variable Cost? Is it Worth Breaking Out? – Restaurant365

686 solutions economics The term _____________ is used to describe the additional cost of producing one more unit. a) average cost b) fixed cost c) variable cost d) marginal cost economics A monopolist is able to maximize its profits by: A) setting the price at the level that will maximize its per-unit profit. Lead Composite Wood

Source Image: facebook.com

Download Image

What is a variable cost: examples and formula – Silverbird 686 solutions economics The term _____________ is used to describe the additional cost of producing one more unit. a) average cost b) fixed cost c) variable cost d) marginal cost economics A monopolist is able to maximize its profits by: A) setting the price at the level that will maximize its per-unit profit.

Source Image: silverbird.com

Download Image

Why Would Someone Sell A Profitable Business? Med Lab Biz Variable costs are directly related to sales, like cost of goods sold. While many think of labor as a variable cost, because scheduling can fluctuate depending on the day, much of your labor cost is actually a fixed expense, or fixed labor. Labor that is paid on a salaried basis, like the head chef, managers, and bookkeeper, doesn’t typically

Source Image: rogersonbusinessservices.com

Download Image

How to Find Variable Cost: A Guide for Businesses These are calculated by taking the amount of labor hired and multiplying by the wage. For example, two barbers cost: 2 × $80 = $160. Adding together the fixed costs in the third column and the variable costs in the fourth column produces the total costs in the fifth column. So, for example, with two barbers the total cost is: $160 + $160 = $320.

Source Image: blog.serchen.com

Download Image

Shift Change: “Just-in-Time” Scheduling Creates Chaos for Workers How much would each unit cost under both the variable method and the absorption method? Solution. The variable cost per unit is $22 (the total of direct material, direct labor, and variable overhead). The absorption cost per unit is the variable cost ($22) plus the per-unit cost of $7 ($49,000/7,000 units) for the fixed overhead, for a total of

Source Image: nbcnews.com

Download Image

How to Price Home Baked Goods and Make a Profit – Better Baker Club Jan 7, 2024Key Takeaways A variable cost is an expense that changes in proportion to production output or sales. When production or sales increase, variable costs increase; when production or sales

Source Image: betterbakerclub.com

Download Image

Think Staffing: Advantages of Variable Labor Costs | TalentLaunch Mar 28, 2023Hub. Accounting. March 28, 2023. A variable cost is an ongoing cost that changes in value according to factors like sales revenue and output. Variable costs include labor, raw materials and distribution costs. Businesses with high variable costs such as contract consulting work have lower margins than other companies but also lower break even

Source Image: mytalentlaunch.com

Download Image

What is a variable cost: examples and formula – Silverbird

Think Staffing: Advantages of Variable Labor Costs | TalentLaunch Jun 22, 2023To recap, the variable costing income statement is different from the absorption costing income statement in several ways. (1) Only variable production costs are included in cost of goods sold. (2) Manufacturing margin replaces gross profit. (3) Variable selling and administrative expenses are grouped with variable production costs as part of

How to Find Variable Cost: A Guide for Businesses How to Price Home Baked Goods and Make a Profit – Better Baker Club How much would each unit cost under both the variable method and the absorption method? Solution. The variable cost per unit is $22 (the total of direct material, direct labor, and variable overhead). The absorption cost per unit is the variable cost ($22) plus the per-unit cost of $7 ($49,000/7,000 units) for the fixed overhead, for a total of